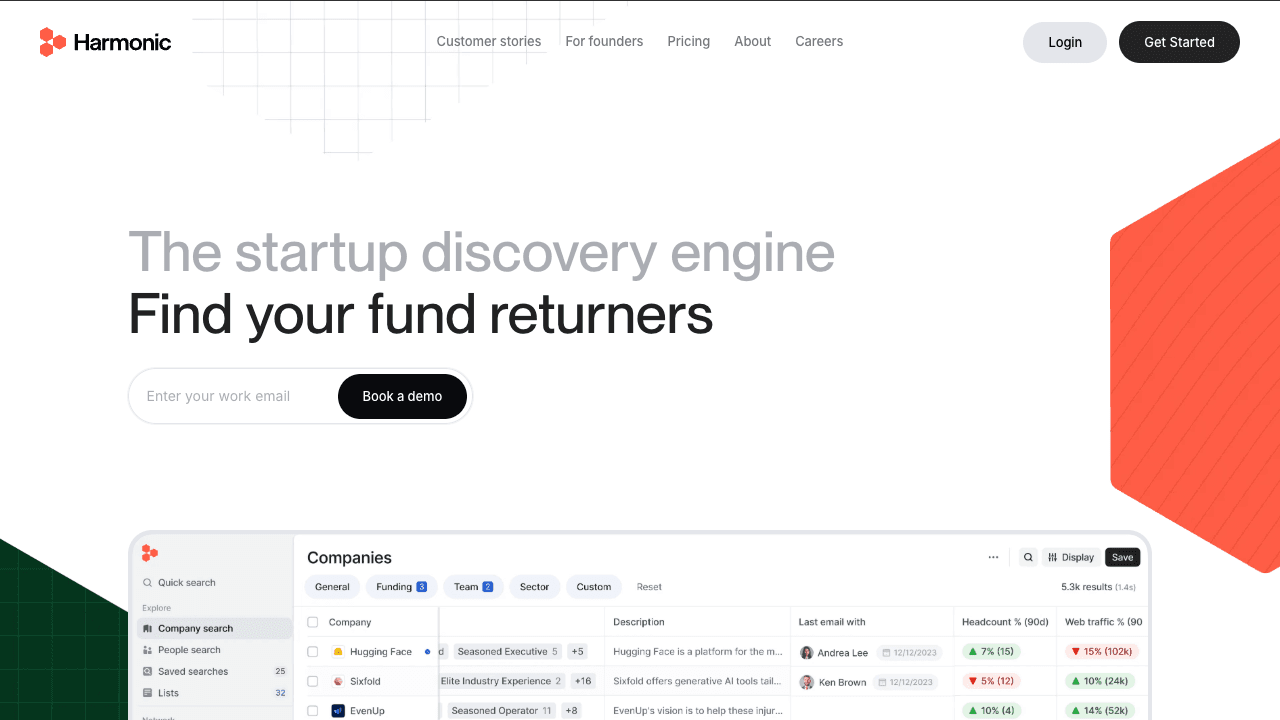

Harmonic

The startup discovery engine for venture capital firms

Powerful AI tool to boost productivity. Compare & discover alternatives.

About Harmonic

Harmonic: The AI Database Transforming VC Deal Sourcing

Discover how Harmonic is revolutionizing venture capital deal sourcing with the first complete, real-time startup database powered by AI and network intelligence.